What are the step-by-step instructions for filling out the W8-BEN?

W8-EXP is typically used by foreign governments and international organizations (among others) that are claiming a withholding tax exemption. W-8IMY is for intermediaries, such as flow-through entities, that are claiming tax benefits. W-8ECI is for foreign individuals or entities who engage in business in the United States. W8-BEN-E is for foreign entities who are claiming foreign status or tax treaty benefits. The W8-BEN is for people who are claiming foreign status or tax treaty benefits Here’s a super quick overview of the W-8 form family: Form Type There are a number of W-8 forms, which can be confusing. What’s the difference between a W8-BEN and other W-8 forms? If the form is not completed correctly, the foreign person could be subject to 30 percent federal tax withholding. What if the W8-BEN is not filled out as required?

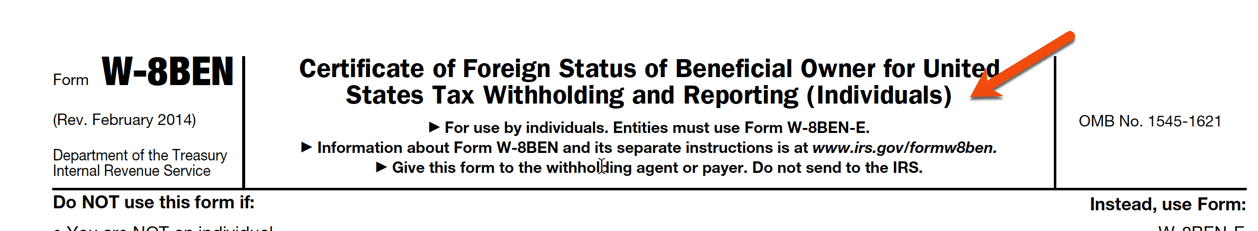

A change in circumstance includes a move to the U.S. However, if there are any changes in circumstances which makes the information on the form incorrect, a new form is required within 30 days. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Generally, Form W-8BEN only gets filled out if requested by the payer (that’s you, the American employer), withholding agent, or foreign financial institution. Foreign entities or those acting as an intermediary should not complete this form. In simple terms: it’s completed by the foreign worker, not by the American business or employer. The W8-BEN is to be completed by a nonresident alien who has received income that would normally be subject to United States tax withholdings. Interest (including certain original issue discount (OID)).This form is also used to establish Chapter 3 or 4 status of the individual to avoid paying taxes on income received from certain sources, including: The W-8BEN is used to establish that your contractor is, in fact, a foreign person and, if applicable, is eligible to claim a reduced rate, or exemption, from income tax withholding as a resident of a foreign country. contractors.) Related Long-COVID Covered as a Disability Under the ADA: How Employers Can Remain Compliant Team Management To ensure that your company is in compliance, you should request a completed Form W8-BEN instead of a Form W-9 from a contractor who is foreign. citizen or resident and therefore shouldn’t be issued end-of-year forms (like 1099s) or be subject to withholding tax. However, you are responsible for maintaining records documenting that your contractor is truly not a U.S. The answer is probably no, especially if your contractor is not conducting business on U.S. If you hired someone from a foreign country to perform services for your company, you may wonder if you are required to issue that contractor a 1099 form at the end of the year. citizens (even if they’re living abroad) or those who live in the United States and have the right to work here. To stay in compliance with current IRS rules and regulations, you probably issue Form 1099 to your independent contractors who are U.S.

0 kommentar(er)

0 kommentar(er)